DW #15 | A Primer on Token Selling Tax

Can a Token Selling Tax substitute a traditional Vesting Mechanism?

A few month ago I’ve stumbled upon Vance Spencer’s tweet on token selling tax. After designing more than 50 different token models, numerous emission schedules and lockup frameworks, the idea actually made a lot of sense, so I decided to go a step further and write this primer on the topic.

The idea is to lay some groundwork and offer a basic framework for others to build upon.

1. The Introduction

We will be incorporate a Token Selling Tax instead of standard vesting and lockup setup. Optimal parameters would still have to be derived, but the initial analysis shows to be quite a promising strategy. But as always, every strategy has its perks and drawbacks.

Potential Benefits

Larger treasury in case of early selling. Tokens could be used for ecosystem support, investments etc. (we assume taxed tokens flow into treasury)

Strategic hodlers will keep tokens locked longer = Lower circulating supply

Speculators will be able to exit earlier, at a relatively higher cost = Less toxic participants

Smaller circulating supply = Less potential sell pressure

Potential Drawbacks

Theoretically lower liquidity

Potential early sell pressure if tax is too low

2. The Starting Assumptions

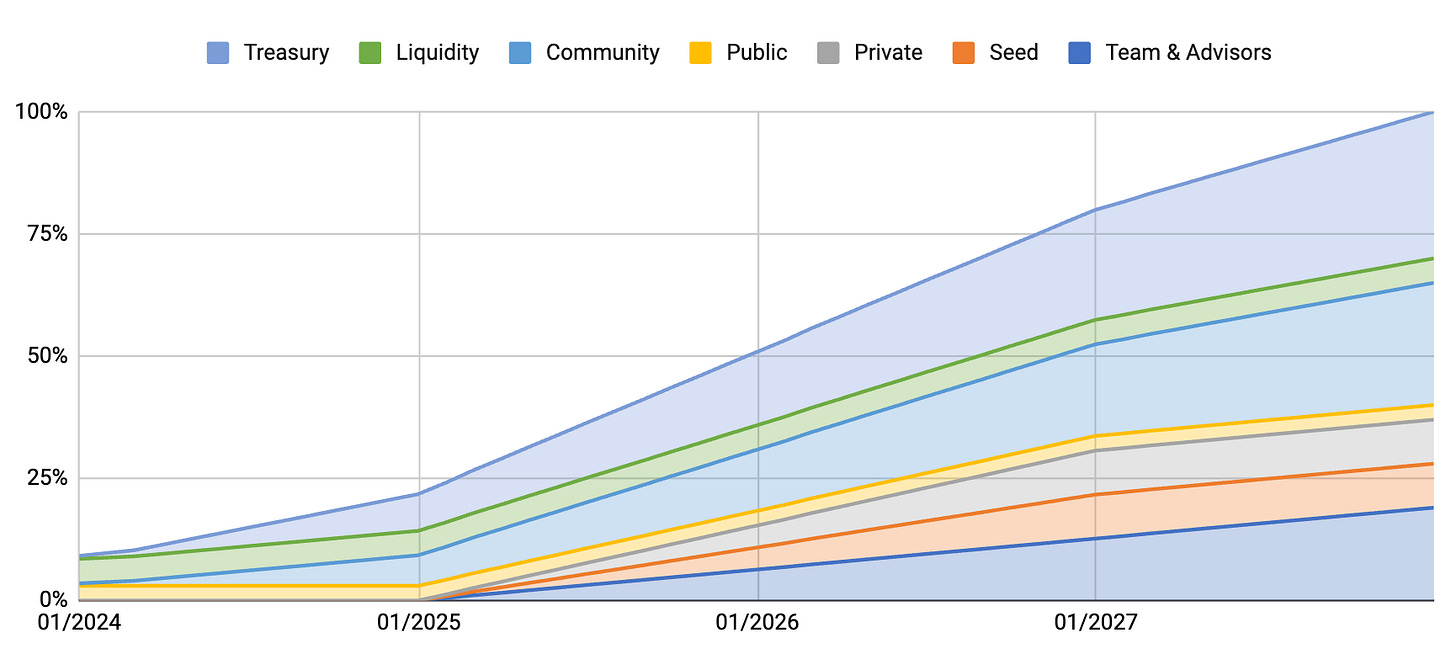

Token Allocations & Vesting Schedule

Let’s assume the following, we take a pretty standard token allocation and emission schedule. As seen in the table, a 9% of total supply is allocated for Seed Sale with 12 month lockup and 36 month vesting.

This essentially means that the first seed tokens will start unlocking after a year and all tokens will be fully unlocked after 3 years have passed. Ok, all clear.

Remark: Total supply and TGE token price is irrelevant for this exercise, hence omitted.

In this case, the unlock schedule would look something like this. Pretty solid, right.

Token Tax Definition

Before we start, we need to define which categories will the token selling tax apply to. A logical start would be to include all non-treasury counterparties that include lockups, such as investors (seed, private), team and advisors.

Theoretically, if there are lockups in place we could include the community allocation as well, but it would probably have to be split into multiple sub-categories.

We now need a starting point for the token tax as well. Depending on when you sell your tokens a pertaining tax applies (e.g. if you sell your tokens within the first year your tax rate will be 90%). Let’s assume the following Token sell tax structure,

Remark: For the sake of this exercise we will assume all affected parties sell tokens at the same time, whenever this may be.

Token Tax Flow

Regardless of the tax rates, one open question remains. Where does the tax go? Well there are a few options:

Tax flows to the Treasury, it can be locked for a certain period of time (preferred) or unlocked. These tokens will act as a reserve or could be spent for community incentives later on

Taxed tokens get burnt. This option is preferred from the tokenomics perspective as it reduces your total supply. Particularly if your model is (highly) inflationary this could be a viable options

A % flows to the Treasury, everything else gets burnt. A combination of both is also an option, which might contain the best of both words.

2. Scenarios

Base Scenarios

Let’s start with a few simplified scenarios. We assume the worst case scenario from the project’s perspective, i.e. tokens are sold at the beginning of each period.

Scenario 1: Tokens are sold in the second month, hence a 90% tax rate applies

Scenario 2: Tokens are sold at the beginning of year two, a 70% tax applies

Scenario 3: Tokens are sold at the beginning of year three, a 50% tax applies

Scenario 4: Tokens are sold at the beginning of year four, a 25% tax applies

Let’s see now compare how the emissions look like in relative terms.

We see that under no scenario 100% is reached (assuming the taxed tokens get burned or locked for a significant period of time). Even though the total supply will be the highest in case four, it may be a preferred option from all counterparties. Why? Well you get taxed less and as a project you delay potential sell pressure to year four which should give you enough time to fully develop the project and generate substantial liquidity. To build upon, it would be interesting to find a Nash Equilibrium for such case, but this is a topic for another time.

Relative total supplies are the following, Year 1 - 66.7%, Year 2 - 74.1%, Year 3 - 81.5% and Year 4 - 90.75%.

Remark: All allocations are included in the charts, including the ones not affected by the tax, though these allocations remain constant.

Cool! Let’s build a few more scenarios. What if an investor decides to sell 1/4 of its allocation at the beginning of each year. We get the fifth scenario.

Scenario 5: Tokens are sold proportionally in 1/4 at the beginning of each year (we skip the first month due to a 99% tax rate)

We get the red line. From investors’ perspective it seems quite good. Total supply will be close to selling everything in year 4, but unlocks happen much much sooner. Total supply in this case reached 88.8% which is around 2% lower than in scenario 4.

Remark: It is important to note that these simulations only consider the amount side of equation. From purely investment perspective, depending on the token price trajectory it might be better to have sold early on, even with paying a higher tax or on the other hand wait until the end. The price is unknown but we can partially align the strategy to the current market state.

Standard Scenario

Right, let’s now compare these scenarios with a standard vesting schedule. Mostly due to the 12 month lockups one is better off with a token sale tax option (speaking from investors’ perspective, the project should look at things in contrary). But then again, we see that the unlocked supply started to increase significantly after 24 months reaching a 100% at the end of year 4.

3. Generalization

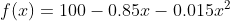

Based on what we’ve built so far, we can derive the following function for Token Selling Tax rate,

where x represents months lapsed since the TGE.

We use this equation to generate the scenario 6, i.e. a linear selling of the tokens. The tax rates at random intervals are approximately the following,

Scenario 6: Tokens are sold proportionally, block by block throughout 48 months.

If we compare a linear selling with a standard schedule or scenario 5, we notice total amount of tokens in circulation is much lower in the years going forward. Good for the project, not that good for investors if they want to exit early, although you get the tokens unlocked daily.

We see that this way that the issue with bigger unlocks at the start of each period are solved due to the tax rate changing on monthly basis.

4. Conclusion

Where there is still a work to be done around the optimal tax rates, the main question remains more of a psychological one. Do you want to incentive selling as late as possible or do you want to get rid of the speculators early on.

All in all taxed tokens can be utilized in a lot of different ways assuming the flow into the treasury. A project can spend them for user incentives, ecosystem support or even burn them to decrease total supply.

5. Further Research

Ideas for future research are plenty. I’ll probably miss a few, but let me list the obvious ones.

What are the optimal token sell tax rates per given month or year

What is the frequency? Can we introduce daily or block by block tax rate function?

Do we need to introduce caps?

Is the 4-year timeframe too short, should we extend it to 5, 7, 10 years?

Can we flatten the curve or should we push for even higher tax in the first years

Which allocations should be affected by token selling tax, and so on.

Implications are endless and feel free to reach out if you decide to give it a go.

Stay salty! 〜