DW #03 | The Ultimate Guide to Web3 Treasury Management: Optimism Case Study

Empowering Growth with Effective Treasury Management

1. Key Principles of Web3 Treasury Management

The main purpose of Effective Treasury Management is to support the longevity of the project. Treasury should be structured to exist in perpetuity which a lot of projects do not consider seriously.

Additionally, key principles of an efficient Web3 Treasury Management should include the following categories of which some of them intertwine,

Risk Management

Capital Efficiency

Liquidity Management

Native Token Management

Partnerships

Later on, we’ll explain each of them in more details.

Treasury should be structured to exist in Perpetuity

To ensure sustainability in the long run, the returns of the treasury along with the revenue should exceed the expenses, but that's nothing new.

How can a project achieve that?

Capital efficiency can be achieved through a diversified asset allocation and efficient risk management - including safeguarding, designing a liquidity buffer and utilising the excess funds. While it works in theory, it gets a bit more complicated in practice, particularly in crypto.

To get a clearer picture, let’s put these principles in practice through the Optimism’s use case.

2. Optimism’s Review

2.1. Introduction to Optimism

A brief introduction on what Optimism is and why I believe it is one of the most important projects in crypto.

Optimism is a low-cost, lightning-fast Ethereum L2 blockchain. In short, it is a scaling solution for Ethereum, where scaling is achieved through running the computation off-chain through the so-called Optimistic Rollups, consequently increasing Ethereum’s transactions throughput and decreasing transaction fees.

Optimism is a Low-Cost, Lightning-Fast Ethereum L2 Blockchain

But this is just the start for the mission driven team behind Optimism, led by Jing, Ben and Karl among others. The team recently launched the Bedrock - the cheapest, fastest, and most advanced rollup architecture. It incorporates years of experience to create a modular, Ethereum-equivalent codebase called the OP Stack.

The OP Stack is a modular, open-source blueprint for highly scalable, highly interoperable blockchains of all kinds. Depending on the type, the transactions on Optimism can be up to 200x cheaper than executing them on Ethereum directly.

Good! Now, let's put everything into a perspective and check how big the Optimism Ecosystem currently is

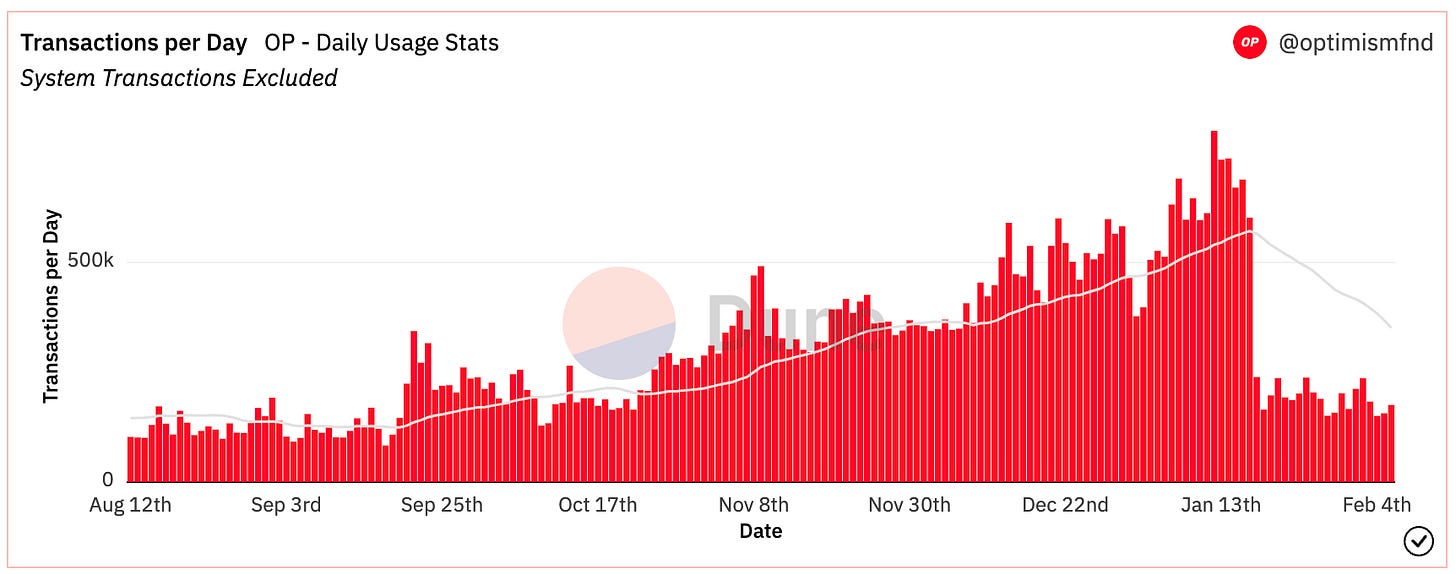

Upon launching Bedrock upgrade Optimism briefly flipped Arbitrum, their key competitor in number of daily transactions.

On-chain value currently sits at 1.9 billion USD with an average 490 thousand daily transactions. And there is more than 80 DeFi projects already building on Optimism.

2.2. Optimism’s Tokenomics

Why the tokenomics section? Understanding tokenomics is a crucial part of any project’s treasury management. You have to understand how the allocations, distribution mechanisms, valuations and unlocking schedules work before making any treasury-related decisions.

Understanding Tokenomics is a crucial part of any project’s Treasury Management

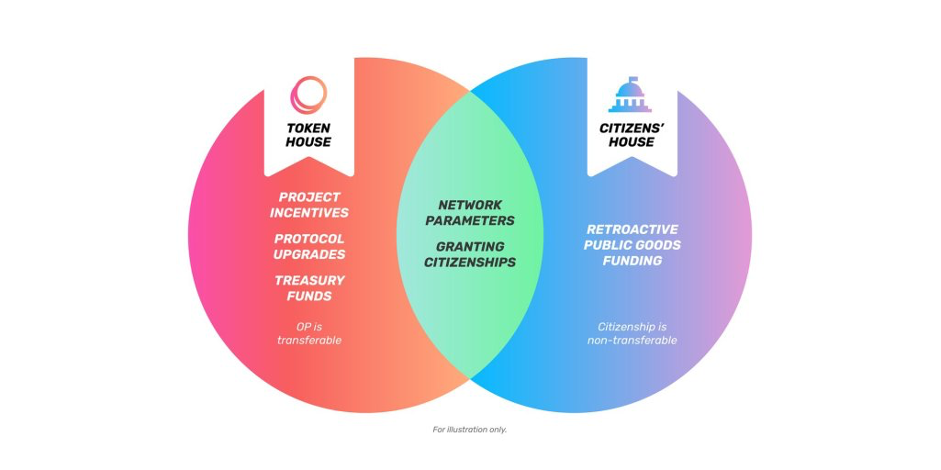

Optimism's token is called the OP and is used to govern network parameters, treasury disbursements, protocol upgrades and creating incentives for projects and users in the ecosystem.

OP token had an initial total supply of 4.29 billion and inflates at 2% per year. Current circulating supply sits at 234 million with a Market Cap of 655 million USD, and includes 161 million OP tokens claimed from the first Airdrop. Fully diluted market cap at current prices amounts to roughly 12 billion USD.

Quite substantial, right. There are multiple opinions that the OP token is overvalued, but that’s not within the scope of this post.

Token generation event (TGE) happened on 31st of May 2022. Roughly 25% of total supply is currently unlocked and it will increase to approximately 64% in year one. If interested in a detailed token allocation read more here.

OP Token has a circulating supply of 234 million OP worth 655 million USD

The most important allocation for ecosystem growth is the Retroactive Public Goods Funding (RPGF) allocation. In a nutshell, projects that contribute to the Optimism’s ecosystem become eligible for the airdrop. If interested in more details check this post. Later on we’ll examine how it affect the foundation’s treasury.

The treasury (or a part of the treasury) will be governed co-equally by two houses: The Citizens’ House and The Token House. The split is roughly presented below.

2.3. Optimism’s Financials

Alright, we have set a base and now it’s time to review what Optimism Foundation holds, earns & spends.

As a disclaimer, the numbers that are not publicly available are pure assumptions. They are used for illustrative purposes and can differ from the actuals.

2.3.1. Fiat & Stablecoin Treasury

Since 2020, Optimism received a total of 178.5 million USD through 3 funding rounds (of which 150 million USD in the latest Series B in May 2022) from some of the most prominent investors in the space (i.e. Paradigm, Wintermute, a16z).

Let’s assume a majority of raised funds are either in USD or stablecoins. At least they should be.

Considering the headcount of around 50 people and estimating the monthly OPEX, Let’s assume that 138 million USD is still available. This will serve as our base for further calculations.

2.3.2. Crypto Treasury

While I don’t have thorough information on Optimism’s crypto allocation, we can estimate how much is the native token treasury worth.

At the current price per token of 2.8 USD, total market cap is 655 million USD with a fully diluted value of 12 billion USD. As mentioned, It is important to note that the estimated unlock supply is to hit 64% at year one, which at current prices means 7.6 billion USD worth of unlocked OP tokens.

Even though most of the tokens are going to be distributed to the community and projects building on Optimism, it is a very significant allocation the team has to manage efficiently.

Later on, we’ll explore the ways of managing the native token treasury.

2.3.3. Revenue

We now know how much the Optimism Foundation owns, let’s now proceed with how much revenue it generates. Optimism profits come mainly from transaction fees which are calculated as

OP Transaction Fee = Fee Scalar x L1 Gas Price x L1 Gas Used + L2 Gas Used x L2 Gas Price

Fees are collected in Optimism ETH and a rough estimation based on available data leads us to the average daily revenue of 60k USD, which in monthly terms amounts to 1.8 million USD.

Average net daily profit in the last 6 months has been between 10-15 thousand USD, but due to recent developments it surged to over 30 thousand USD in January 2023. For our use-case let’s assume the average of 20 thousand USD daily. That amounts to 600 thousand USD on a monthly basis.

On an average day, Optimism generates 60k USD in Revenue and 30k USD in Net Income

2.3.4. Expenses

Please note that no public data was available and that this is a broader assumption calculated based on the available headcount number, salary base and estimation of other costs such as SG&A. For the purpose of our model let’s assume a yearly OPEX of 18.7 million USD or roughly 1.6 million USD on a monthly basis.

2.3.5. Summary

Let’s summarise all the numbers we are going to use for our use case.

Fiat/Stablecoin Balance: 138 million USD

OP Treasury Balance: 800+ million unlocked OP (assumed)

Revenue: 1.8 million USD / per month

Net Profit: 600 thousand USD / per month

Expenses: 1.6 million USD / per month

3. Optimism Treasury Management

3.1. Introduction

Broadly, Optimism Treasury Management can be split into three main pillars:

Financial Management – Managing the treasury and ensuring capital efficiency both in native token allocation as well as other holdings.

Stakeholder Management – Managing the governance side and pertaining incentives. This includes investors as well.

Ecosystem Management – Managing Treasury for Retroactive Public Goods Funding and Community incentives and ensuring the ecosystem runs smoothly.

Let’s now merge these principles with the numbers presented above.

3.2. Budget Planning

The first step is to consider what is the ultimate goal of Optimism Foundation and what the project is trying to achieve. One of the key features is the Retroactive Public Goods Funding, to which the whole revenue flows. With a logical mission of scaling Ethereum and making the transactions cheaper, the core mission would be to grow the ecosystem through rewarding, helping and supporting the projects building on Optimism.

Budget should be set by having this in mind, searching for an equilibrium between the cost of management, cost of development and RPGF expenses on one hand and projected transaction revenue on the other.

Following a huge Series B funding sum there is a significant runway available and ideally all excess funds should be utilised on the market through risk-adjusted investments. Optimism Foundation is already generating a solid revenue that currently flows to RPGF, meaning there is a buffer to change the Revenue redistribution dynamic if darker days come in the future.

3.3. Fiat & Crypto Treasury Management

According to the numbers presented above we do not hold any information on the size of other crypto holdings. Additionally, we skip the OP token treasury in this section, as it should not be considered a liquid part of the treasury (see Hasu's post for the logic behind).

Native token should not be accounted for as a liquid reserve

Let’s focus on the numbers we are familiar with and how to optimise pertaining allocations.

3.3.1. Ethereum

We know that Optimism Foundation’s net earnings are roughly 608 thousand USD per month, collected in Optimism ETH. On annual basis that's roughly 7.3 million USD equivalent.

Meaning, if the ETH price goes down, net revenue in USD decreases and vice versa. Although at this point, all the network fees and sequencer revenue are to be allocated to the Retroactive Public Good Funding it is still important to lock-in a portion of the revenue and reducing its volatility.

ETH 10-day VaR sits at 22%, meaning if one holds 100 million worth of ETH there is a 5% chance that in any 10-day period portfolio may drop for 22 million USD.

What can and should Optimism Foundation do with ETH?

a) Hedge ETH with Futures or Options: If we believe the markets are not yet hit the bottom, hedging at least a certain percentage of the revenue seems logical. The global economy doesn't look too promising, but considering that FED aims to stop with rate hikes later this year and that ETH is still 65% down from the top, hedging at current prices is not an obvious decision.

b) Diversification: Another alternative to hedging converting a certain % of ETH into stablecoins on a regular basis regardless of the price (e.g. weekly, monthly, monthly), hence mitigating the volatility. Consider this as some sort of DCA.

c) Utilizing the Excess ETH: Considering that both lending and staking of ETH poses certain risk, the latter may be a better option based on a risk-adjusted return – the yield is roughly 4% for staking and around 1% for lending. It is important to minimize the counterparty risk so a proper allocation and sizing is important. Also account for the locking periods.

d) Risk Management & Safeguarding: Regardless of the above, everything that is not needed for a short-term liquidity should be held in cold wallets. My advice would be to target 90%+. Also, minimize exposure to crypto exchanges.

3.3.2. Fiat & Stablecoins

Based on our assumptions above there should be roughly 138 million USD still available. Let’s assume it is either in stablecoins or fiat. The amount is substantial and ensures a runway long enough not to take unnecessary risks.

Considering that DeFi lending rates on stablecoins are between 1.5-2.5% (Yearn, Aave, Compound) and pose much higher risk than the US Treasuries, which currently yield about 4.6% per annum (projections show FED aims to increase the rates up to 5% this year) the direction should be clear.

In this environment there is no Risk-Adjusted reason to be exposed to DeFi Stablecoins Products

What should Optimism Foundation do?

a) Crypto-to-Fiat: Leaving aside the fiat vs. crypto debate, and focusing Capital Efficiency. This conversion mostly tackles the Stablecoins vs. Fiat reasoning.

Currently, the market shows us reasoning to convert all the excess funds into USD (depending on the jurisdiction tax implications may be relevant). Leave in stablecoins only what is necessary for a near-term liquidity (6-12 months should be sufficient).

With such a significant amount it is important to limit the counterparty risk by keeping the majority of the funds with the most reliable bank available (e.g. Signature Bank) and dispersing the rest.

Apart from the short-term runway (i.e. target 3 months) put everything into “risk-free liquid” investments. By this I’m targeting either short-term US T-Bills (aim for maturities up to 3 months) or Money Market Demand Accounts (which are FDIC insured). Both currently yield 4.6%+ per annum.

Note: We are assuming that Optimism Foundation still operates as a private company as in the case of a DAO, converting crypto to fiat gets very very complicated and in most cases might not even be an option.

Suggestion: In Q1 & Q2 2023 roll-over the T-Bills on monthly or bi-monthly basis to benefit from increasing interest rates, in Q3 2023 aim for a slightly longer maturity.

According to my calculation the total amount Optimism Foundation should invest in Treasury products is around 119M USD.

Investing according to the above plan, Optimism Foundation should be able to earn 5.5 million USD of risk-free passive return in 2023. To put this into a perspective our net profit estimation for the whole year is 7.3 million USD and a yearly OPEX is estimated to be roughly 18.7 million USD. Meaning Optimism Foundation could cover almost 30% of their operating expenses by allocating excess capital in risk-free Treasury products. Amazing isn't it.

Optimism Foundation should be able to earn 5.5 million USD of risk-free passive return, which is 30% of it’s Yearly OPEX.

b) Diversification & Counterparty Risk: As mentioned above, holding a substantial amount of cash calls for a dispersion among a few banks. Rate them based on Total Assets and Liquid Capital to lower the Counterparty Risk.

c) Safeguarding: It can’t be said too many times, so keep stablecoins in cold wallets.

3.4. OP Treasury Management

Let's now take a look at how could the OP Treasury be managed. Depending on the underlying strategy there are several different approaches Optimism Foundation could take.

Let’s divide this into a few subsections tackling each of the treasury management principles.

3.4.1. Risk Management

Due to the size of the OP Treasury an efficient risk management is crucial, again if possible, keep the majority of the funds in cold wallets. Most of these tokens are yet to be distributed for the ecosystem growth, so safeguarding is as equally important.

Risk Management is one of the most important principles for Web3 Treasuries

Let me show you why risk managements is one of the most important principles in sustainable growth of the project. A 10-day VaR of OP token sits at 41%. In practice this means that by considering the current unlocked supply of 2.4 billion USD worth of OP, there is a 5% chance that in any given 10-day period in time, that the OP Treasury value would drop for 41% or 980 million USD. Quite a significant drop isn't it?

A 10-day VaR of OP token equals 41% - There is a 5% chance that in any given 10-day period in time, the OP Treasury would drop for 980 million USD.

3.4.2. Strategic Partnerships

Strategic partnerships take an important part in treasury diversification. Although, Optimism Foundation in a sense considers this through RPFG there is always a room for a Strategic Token Swap (either 1:1 or preferably disproportionate). This way achieving an additional diversification of the OP Treasury.

It is important to note that strategic is a key word here. Only opt-in for a token swaps that have a strategic reasoning behind. It is also advised to have a lockup or vesting agreement in place to minimize potential sell pressure on both sides.

3.4.3. Token Unlocks

Tokenomics is an important part of treasury management, in particular managing the Supply-Demand Ratio. Token unlocks are one such event and there is one particularly large unlock happening in 2023 – An upcoming team and investor 3.6% cliff unlock on June 1, 2023.

Based on current price this unlock is worth roughly 430 million USD and there is an additional unlock each month. With the last raise for Optimism being at $1.65 billion, implying investors are up 5x or more on their initial investment.

Tokenomics is an important part of Treasury Management which reflects particularly in managing the Supply-Demand Ratio.

As the practice in crypto shows, a majority of these tokens are most probably going to get dumped on the market causing a large sell pressure and of course you don't want this to happen.

How should Optimism Foundation manage this? Well there is not a single right way, but let’s explore a few options.

a) A Short-Term Hedge: Optimism can hedge against the unlock for a similar amount that is estimated to be sold.

b) OTC Deal: Have a discussion with the largest investors who plan to sell the tokens and try to agree on a OTC deal or a buyback of locked & unlocked tokens at a discounted price. Manage accordingly as you don't want to spend to much capital doing this.

c) Buy Pressure: Aim to create a stronger buy pressure at the unlock date, e.g. new product release, OP holding requirement even a buyback would do, to mitigate at least some of the sell pressure.

3.4.4. User Incentives & Retroactive Public Goods Funding

This is one of the most important pillars in Optimism's business strategy. Considering 20% of the initial token supply falls under this category as well as the recurring revenue stream, the total value of this allocation is in the range of 1.9 billion USD (FDV at current prices) plus ongoing monthly revenue.

The key is to maximize the amount available for RPGF and the Community, while mitigating any potential large sell pressure event (as happened in the past).

How to maximize the Ecosystem Allocation?

I won't go into much details here, but as described above, an equilibrium between the diversification, safeguarding & hedging should do the trick.

How to mitigate the sell pressure?

First time this happened was at the first Airdrop when OP token plummeted 40% as a consequence of early adopters selling out their tokens. Since then there has been a broader community proposal to mark these users ineligible for all future airdrops as they are not contributing to the ecosystem longevity - This should indeed have some positive effects in the mid-term, though might not be the best solution.

But what other options do we have? One option is to do a lockdrop or a vested airdrop, this would release tokens gradually and even if the sell pressure happens it would be much less severe and much easier to absorb. Ideally this should be considered as another governance proposal.

Lockdrops or vested airdrops can help mitigate sell pressure from traditional aidrops.

While the second trigger has not yet resulted in a sell pressure, it might do. Optimism's usage collapsed in the last weeks due to the Quest (an incentive program) coming to an end. The price hasn’t followed yet, but as suggested above some of the risk-mitigation strategies could be applied to absorb any potential upcoming sell pressure.

3.4.5. Hedging & Investing

As mentioned, fiat and stablecoins VaR is equal or very close to 0, while on the other hand ETH and OP have much higher VaR values.

Should Optimism hedge some of the positions and what other options are available?

3.4.5.1. Futures & Perpetual Swaps

The main difference between the two is that Futures have an expiration date, while Perpetual Swaps don't, but you do pay a continuous funding fee for maintaining the open position. Both require a certain amount of collateral, resulting in a locked capital.

Depending on the Funding Rate, a Short position in Perpetual swaps is suggested for shorter time frames, while a short position in a futures contract may be cheaper for longer time frames.

3.4.5.2. Put Options

Put options give investors the right to sell an asset at a specified price within a predetermined time frame. In practice it works as a hedge against the falling price of the underlying asset. The premium might be significant due to highly-volatile nature of ETH and OP.

Put Options in Crypto are again advised for a Shorter-Term Hedge.

3.4.5.3. Range Tokens

Range tokens in crypto are what Convertible bonds are in traditional finance. In practice this means that a project can borrow funds by putting its native tokens as a collateral without actually selling it.

It is indeed a very interesting product for treasury diversification, however due to sufficient liquidity buffer it is not needed at this point.

3.4.5.4. KPI Options

The value of KPI Options depend on hitting certain target, such as TVL, Volume or DAU, thereby giving every recipient an incentive to help in the protocol growth. It further helps mitigate the sell pressure and extensive dump of the airdroped tokens.

It could be worth exploring additional options to incentivise the ecosystem participants and mitigate the sell pressure of the airdropped tokens. However, not a crucial task at this point.

These are only a handful of projects and options any Web3 Project can utilize. Always make sure you choose a few that seem the most suitable for your goals. As usual, less is more!

4. Conclusion & Key Findings

We came to an end. While the Principles of Treasury Management are common to the industry, no two projects have equal product mechanics, funding needs and targets. It is similar with tokenomics, therefore meaning that each project should be analysed and optimized on its own and it is dangerously to generalize and put everything in the same basket.

Again, key principles that every project must be aware of are Risk Management, Liquidity Management, Native Token Management and Capital Efficiency.

Let’s know summarize our use case findings, and add key action points to the findings.

Action Points - Revenue Diversify by recurring conversion, invest excess according to the Plan and safeguard everything else in a Cold Wallet Storage.

Action Points - Fiat & Stablecoins Convert all excess funds from stablecoins to USD. Keep stablecoins in cold wallets and invest the USD in short-term T-Bills or MMDA. Mitigate counterparty risk by having more exposure towards larger banks & counterparties.

Action Points - OP Treasury Keep excess tokens in cold wallets, diversify through strategic partnerships, mitigate potential sell pressure from larger token unlocks and airdrops and hedge if necessary.

This article is quite an insightful one. I made the switch to Web3 treasury from traditional bank treasury and this post has improved my knowledge of managing native tokens. Inspired to make further research and learnings.

Really really great post. This is the kind of stuff that will allow teams who are building to win through the bear and explode in the bull. Great stuff.